Market Overview:

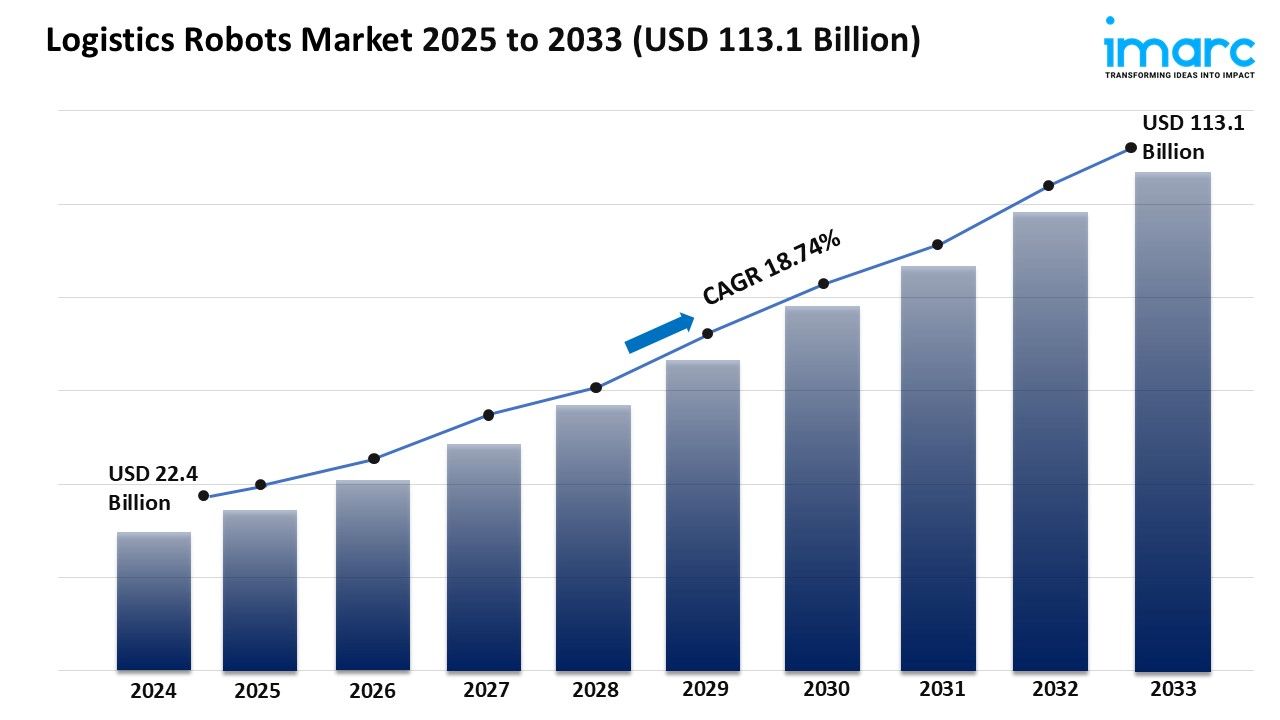

The logistics robots market is experiencing rapid growth, driven by explosive e-commerce demand, technology advancements and smart automation, and government support and investment in automation. According to IMARC Group’s latest research publication, “Logistics Robots Market Report by Component (Hardware, Software), Robot Type (Autonomous Mobile Robots, Automated Guided Vehicles, Robotic Arms, and Others), Function (Pick and Place, Loading and Unloading, Packing and Co-Packing, Shipment and Delivery, and Others), Operation Area (Factory Logistics Robots, Warehouse Logistics Robots, Outdoor Logistics Robots, and Others), End Use Industry (E-Commerce, Healthcare, Retail, Food and Beverages, Automotive, and Others), and Region 2025-2033”, the global logistics robots market size reached USD 22.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 113.1 Billion by 2033, exhibiting a growth rate (CAGR) of 18.74% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/logistics-robots-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Logistics Robots Market

- Explosive E-commerce Demand

One of the most powerful forces fueling the logistics robots industry right now is the unstoppable surge in e-commerce. Consumers everywhere are demanding faster, more accurate deliveries and greater convenience, putting enormous pressure on supply chains to operate efficiently and at scale. Major retailers and platforms, including Amazon, Alibaba, and Walmart, have responded by deploying fleets of autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) to handle picking, sorting, and packing in their giant warehouses. Automated systems dramatically reduce human labor for repetitive tasks, boost accuracy, and help companies manage spikes in order volumes. The outcome? More orders fulfilled, fewer mistakes, and much shorter turnaround times. E-commerce giants now view automation as essential—and are investing billions, making robotics ubiquitous in the warehouse sector. With expectations for same-day or next-day delivery becoming the norm, the logistics robots sector is racing to keep up with this relentless pace.

- Technology Advancements and Smart Automation

The second major growth pillar is the rapid advancement of technologies such as artificial intelligence, machine learning, and sophisticated sensor systems. Today’s logistics robots are far more than simple machines—they actually “think,” learning from past data and appearing almost intuitive on the job. With tools like computer vision, LiDAR, and 3D sensors, robots can accurately spot, identify, and handle products of diverse shapes and sizes, even in chaotic warehouse environments. These improvements mean logistics robots are now safer, smarter, and able to operate alongside human workers with minimal risk. Innovations in collaborative robots, or “cobots,” let robots work shoulder-to-shoulder with staff, handling everything from order picking to packing. All these breakthroughs add up to greater efficiency, fewer errors, and maximum throughput for logistics businesses around the globe.

- Government Support and Investment in Automation

A third key growth driver is strong backing from governments eager to modernize their logistics sectors, boost efficiency, and cut costs. For instance, national policies such as India’s National Logistics Policy promote digitalization and automation to create a cost-efficient, resilient logistics ecosystem. India’s PM GatiShakti Master Plan aims for multi-modal connectivity and green logistics, reducing emissions and increasing supply chain transparency. In addition, state schemes like Gujarat’s Financial Assistance to Integrated Logistics Facilities offer targeted capital subsidies for businesses investing in advanced logistics parks and tech-enhanced warehouses. Such programs bring down entry barriers, encourage automation adoption, and create a supportive ecosystem where companies of all sizes can benefit from the latest robotics technologies.

Key Trends in the Logistics Robots Market

- Rise of Autonomous Mobile Robots (AMRs) Across Operations

Autonomous Mobile Robots (AMRs) aren’t just a buzzword—they’re showing up in logistics operations everywhere, taking on core tasks like moving pallets, picking products, and managing internal transportation. These robots navigate bustling facilities using advanced mapping and avoid obstacles in real time, which means they can operate safely right alongside people and forklifts. Major third-party logistics providers now deploy hundreds of AMRs to streamline distribution and ramp up throughput. For example, Yusen Logistics has deployed a 165-robot automation system at its UK distribution center, significantly increasing picking efficiency and space utilization. Global logistics leader DHL has incorporated over 7,500 robots into its warehouses and invested more than $1.17 billion in automation for its contract logistics business. As AMRs get smarter and more affordable, expect their adoption to keep accelerating.

- Collaborative Robots (Cobots) Working With Humans

Collaborative robots, or cobots, are changing the game by safely working alongside human teammates and making everyone’s job easier and more efficient. Unlike traditional robots that require special safety zones, cobots are designed with intelligence, sensors, and AI that let them handle repetitive or dangerous tasks, freeing up people for higher-value work. Tech leaders like Universal Robots and ABB are launching cobots equipped with machine vision and smart sensors that adapt to changing needs on the fly. Revenue from collaborative robotics hardware is surging, with market research projecting $1 billion for this segment in just one year. Warehouses are fast embracing these partnerships to reduce operating costs and scale up quickly—cobots now help with order picking, packing, and complex handling tasks, often boosting both accuracy and morale.

- Robotics-as-a-Service (RaaS) and Flexible, Scalable Logistics

A standout trend in logistics robotics is the shift toward service-based models. Robotics-as-a-Service (RaaS) allows companies to “rent” robots and automation tools instead of buying them outright, massively lowering upfront costs and letting even smaller businesses get in on the action. This flexible approach means logistics firms can easily scale their operations up or down to meet fluctuating demand, without worrying about massive capital expenditures. In practice, this model is unlocking access to advanced robotics for a much wider range of players—everything from large distribution networks to midsize retailers and regional 3PLs. RaaS gives operators the freedom to experiment, optimize, and future-proof their logistics strategies without being tied down by expensive hardware or long-term commitments. As real-world case studies continue to highlight the speed and value of RaaS, its role in supercharging global logistics is only set to grow.

We explore the factors propelling the logistics robots market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Global Logistics Robots Industry:

- ABB Ltd

- Boston Dynamics

- Dematic (KION Group)

- Fanuc Corporation

- KUKA AG

- Locus Robotics

- SSI Schaefer

- Yaskawa America, Inc.

Logistics Robots Market Report Segmentation:

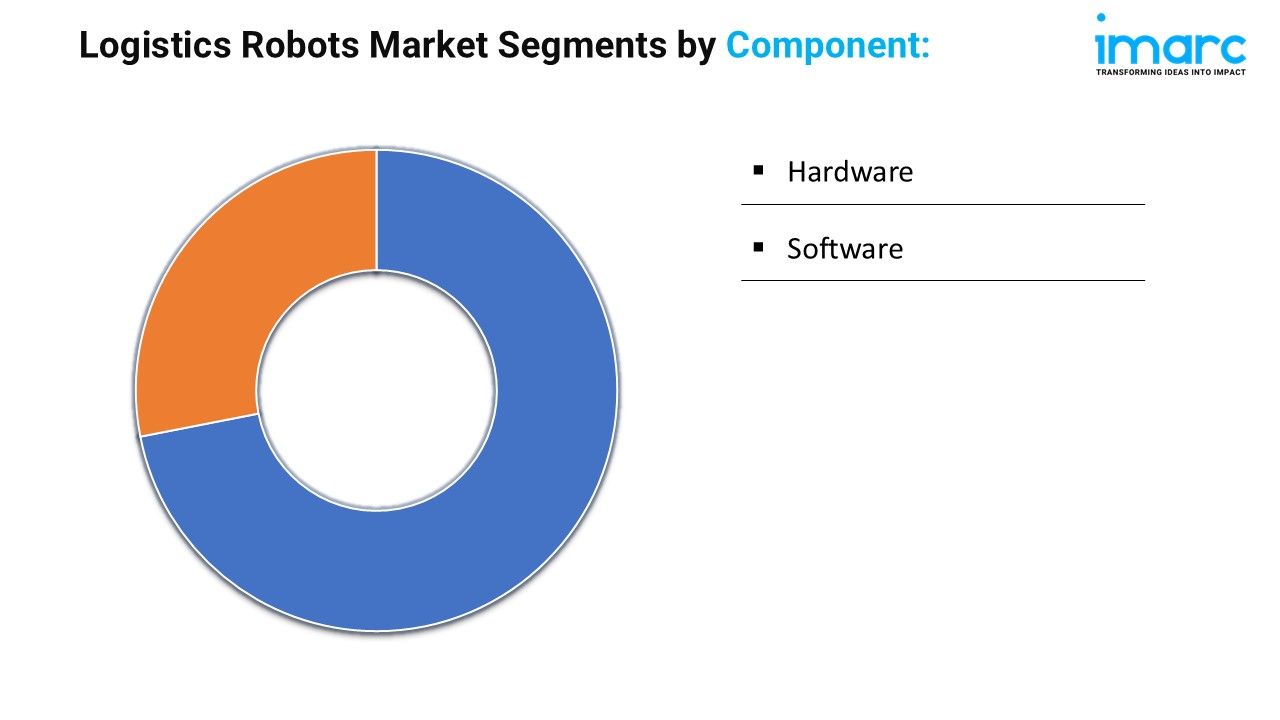

By Component:

- Hardware

- Software

Hardware is the dominant segment in the logistics robots market, representing the largest market share. This includes essential physical equipment and machinery, such as the core structure or chassis, actuators, and grippers, which are crucial for the operation and functionality of logistics robots.

By Robot Type:

- Autonomous Mobile Robots

- Automated Guided Vehicles

- Robotic Arms

- Others

Automated Guided Vehicles (AGVs) hold the biggest market share among different robot types. These mobile robots are specifically designed to transport materials or goods within predefined areas, such as warehouses and manufacturing facilities, following predetermined paths marked by guides like magnetic tape or laser systems.

By Function:

- Pick and Place

- Loading and Unloading

- Packing and Co-Packing

- Shipment and Delivery

- Others

Pick and Place functions represent the leading market segment within logistics operations. These robots are integral to warehouse activities, performing tasks such as order picking, sorting, and assembly with precision, utilizing various end-effectors to grasp and position items accurately.

Operation Area:

- Factory Logistics Robots

- Warehouse Logistics Robots

- Outdoor Logistics Robots

- Others

Factory Logistics Robots exhibit clear dominance in the market, operating within manufacturing environments to optimize internal material flow, inventory management, and production processes. They include AGVs and robotic arms that facilitate efficient transport and handling of materials.

End Use Industry:

- E-Commerce

- Healthcare

- Retail

- Food and Beverages

- Automotive

- Others

E-Commerce accounts for the majority of the market share, as logistics robots play a vital role in streamlining order fulfillment processes, managing inventory, and enhancing warehouse operations to meet the growing demands of online shopping.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific leads the logistics robots market, capturing the largest market share primarily due to the booming e-commerce sector in the region. Additionally, favorable government initiatives and investments in automation technologies further support the growth of the logistics robots market in this area.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302